Significance of outsourcing accounting functions at the right time

Outsourcing accounting services to professional firms has become a new trend globally. Gone are the days when people used to hire full-time in-house accountants to manage the company’s accounting needs.

The importance and increasing demand of outsourcing accounting requirements came into the picture when companies with in-house accountants realized that they were spending an unnecessary amount on retaining a full-time accounting employee, spending for their training, and risking the company’s confidential information with the probability of fraud or manipulation.

The power of outsourced accounting can be best yielded when the decision to outsource the tasks is made at the right time, before spending too much in building an in-house team of accountants or possibly exploiting the company’s resources by such a team single-handedly controlling the accounting activities.

This article presents the benefits of outsourcing accounting services and the best time to start leveraging the power of the same.

Why should you leverage the power of outsourcing?

Many small and medium-scale business owners have experienced the power of accounting services. Here are the benefits you can expect.

1. Reduced payroll headcounts and related administration cost

In simple words, hiring in-house full-time employees is an expensive affair. Not just you have to pay monthly salaries, but you also have to spend money on their development and keeping them updated on the amendments. After doing all this, they are still open to considering any better opportunity and may move out of your company.

But suppose you are outsourcing the accounting needs of your business. In that case, you simply do not have to worry about anything because it is not just a relatively cheaper option (pay for your work and not for retaining a person, no additional cost for training, etc.) but also comes with the guarantee that your work will not be hampered even if the accountant changes.

2. Experts at your service

Business owners usually have a lot of things on their minds, and they find it difficult to focus on all those things at once. Besides this, an individual cannot be skilled at doing everything, so the need for and importance of outsourcing comes into the picture.

An outsourced agency is a team of highly qualified professionals who will effectively take care of your project, allowing you the bandwidth to focus on your core business operations.

3. Window to strengthen the core competencies

Accounting can be tedious and challenging and requires much effort. It restricts you from focusing on the core competencies of your business. Further, business decision-making depends on factual data, detailed market studies, and related statistics.

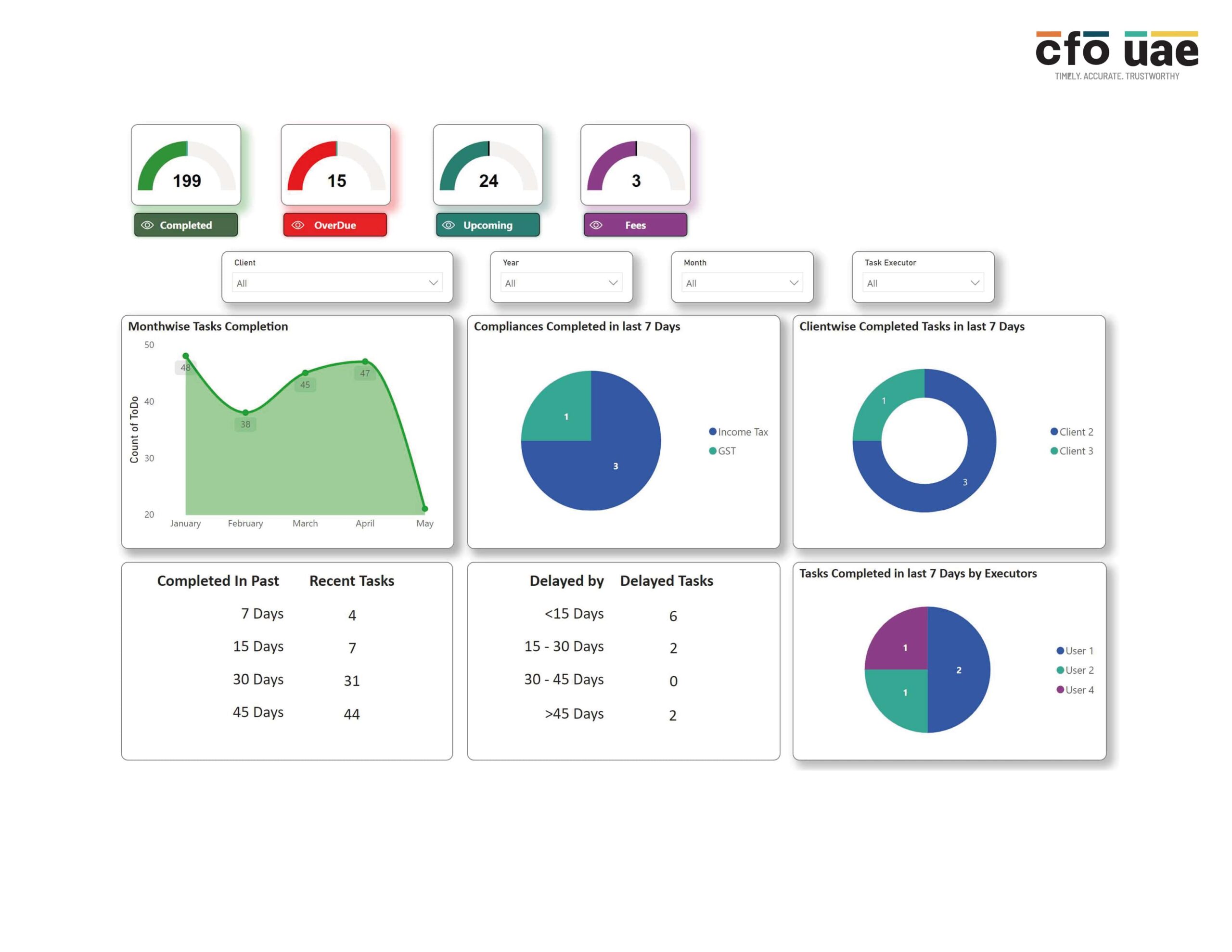

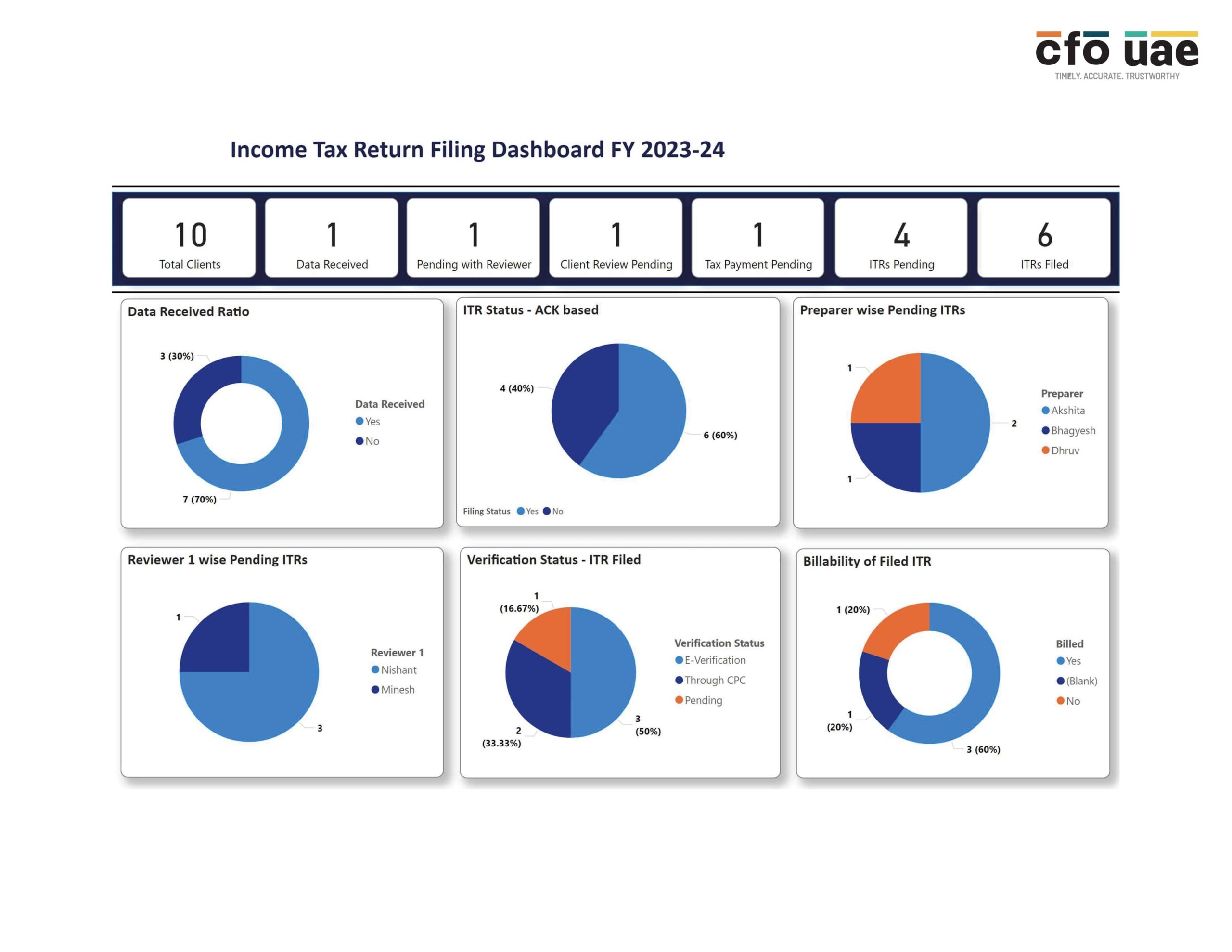

Outsourcing your accounting function will offer your intelligent dashboards and statistical reports to make informed business growth decisions and develop strategic ideas and competitive strategies that will take your business to a new level.

What is the right time to outsource the accounting functions?

As it is said – “There is no wrong time to do the right thing.”

The appropriate time to leverage the power of outsourced accounting depends on your business needs and growth stage.

If you face the following instances, it is time to find a trusted, efficient, and reliable outsourced accounting service provider.

- The unnecessary cost involved in managing the in-house team of accountants and bookkeepers.

- Regular spending on the training of the in-house accounting team to freshen up their concepts and stay updated on recent regulatory updates and changes.

- Need a separate professional for managing the taxation activities of the company.

- It seems like too much dependency on a single person, with the possibility of manipulating the accounting records and misusing the company’s resources.

- Unnecessary time is spent reviewing the in-house accounting team’s work and rectifying the errors.

- Delay in the availability of the management information reports required for business strategies and decisions.

- The in-house accounting team works for 12 person-days a month, yet salaries are to be paid for the month to retain them.

- No intelligent insights are available from the in-house accounting team.

- Single-handedly managing the business operations and accounting functions impacts your business’s productivity (as you need more time to manage the primary business functions).

- In case of any team member leaves, the accounting work gets disrupted for a considerable period until the new employee joins in and gets along at the same level as the previous employee.

- The business is in its growth stage, where the volume of transactions is increasing, requiring more time to manage core business activities, while dedicated time is required to handle accounting functions on a timely basis.

- Doubts about the company’s data security.

If you have answers to these questions, you have already won half of the battle.

The outsourced accounting firm you should go with -

Here are a few parameters you should consider while selecting an appropriate outsourced accounting firm:

1. Data security and privacy

You should always communicate with the accounting service provider that you prioritize your data security and shall insist on the following:

- Lock-down rights and security controls.

- SSL Encryption.

- Multi-level authentication systems.

- Requirements for safe and secure passwords.

2. Check out the age of the firm and clients’ testimonial

Before handing over your company’s accounting needs to any firm, you must briefly check that company’s history. Business accounting is very private and confidential for any business, so you cannot risk its integrity.

The company to whom you should outsource your requirements should be in the industry for quite some time. The more years a company has been in the market, the old players might have worked with multiple clients from different industries.

3. Responsibilities and ownership

Accounting is one of the significant aspects of any business. Sometimes outsourcing this function means giving up on your ownership of the company. However, this shouldn’t be the case. When you outsource your accounting function, you need to mention what roles and responsibilities must be performed by the accounting service provider and what parts solely remain with you.

It is essential to discuss and include in the contract to avoid any scope of fraud or manipulation of confidential business information.

How can CFO UAE assist you?

CFO UAE is the leading firm managing its clients’ accounting functions across various industries. CFO UAE provides a wide range of outsourced services, such as managing your bookkeeping and accounting, handling your tax compliances, providing virtual CFO services, and managing your payroll functions.