ITR Tracker Dashboard Creation Service

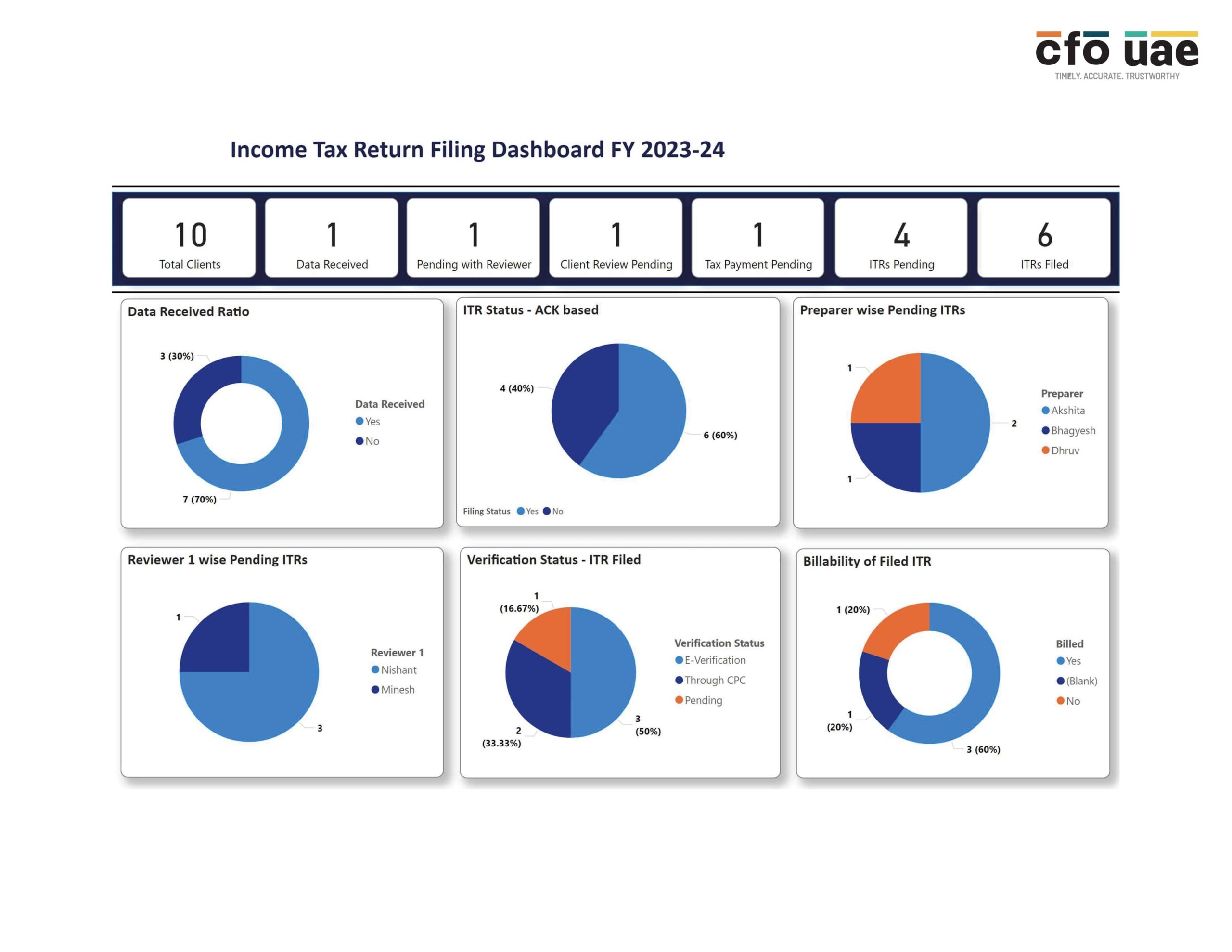

With our ITR Tracker Dashboard creation service, you can track income tax returns with ease. With the automated approach, you can avoid delays and inefficiencies. It will provide you with insights into ITR filing, such as total clients received, ITR pending, etc. Therefore, it will make it easier to do the filing and one will be able to do more work in lesser time

Problem Statement

In the past, tracking the status of Income Tax Return (ITR) filings was a cumbersome process. Management had to rely on the compliance team to provide updates on filing statuses. This manual approach often led to delays and inefficiencies, making it challenging for management to monitor the progress of ITR filings effectively.

Solution

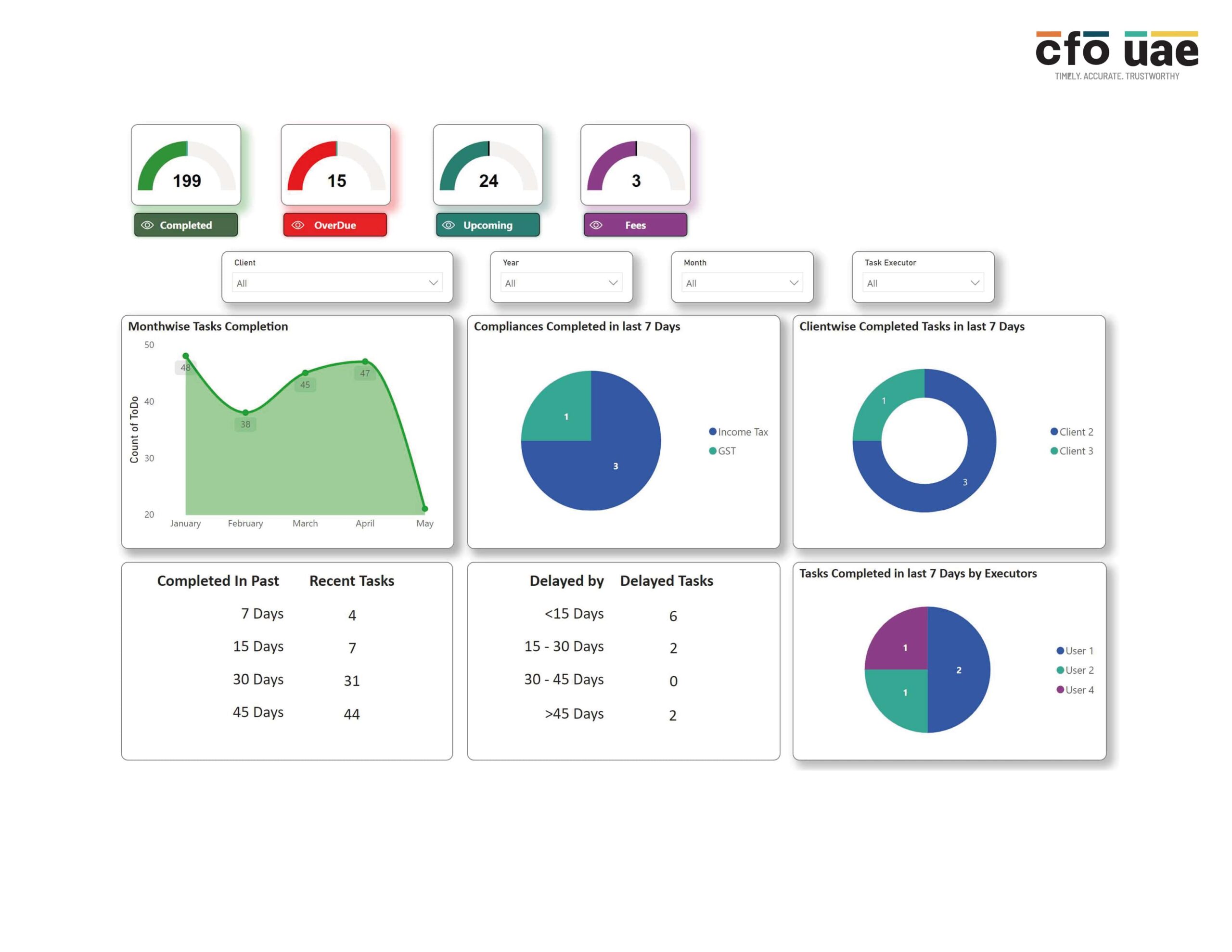

The implementation of the Income Tax Return Filing Tracker dashboard revolutionized the way management tracks ITR filings. Here are the key features and benefits:

1. Real-Time Updates:

- The dashboard provides real-time updates on the status of ITR filings. Management no longer needs to wait for manual reports or follow up with the compliance team.

- Instant notifications alert management when a filing is complete or if any issues arise during the process.

2. Centralized Information:

- All ITR filing data is centralized within the dashboard. Management can access it from a single platform, eliminating the need to search through multiple systems or spreadsheets.

- The dashboard displays filing details, including submission dates, pending filings, and any outstanding requirements.

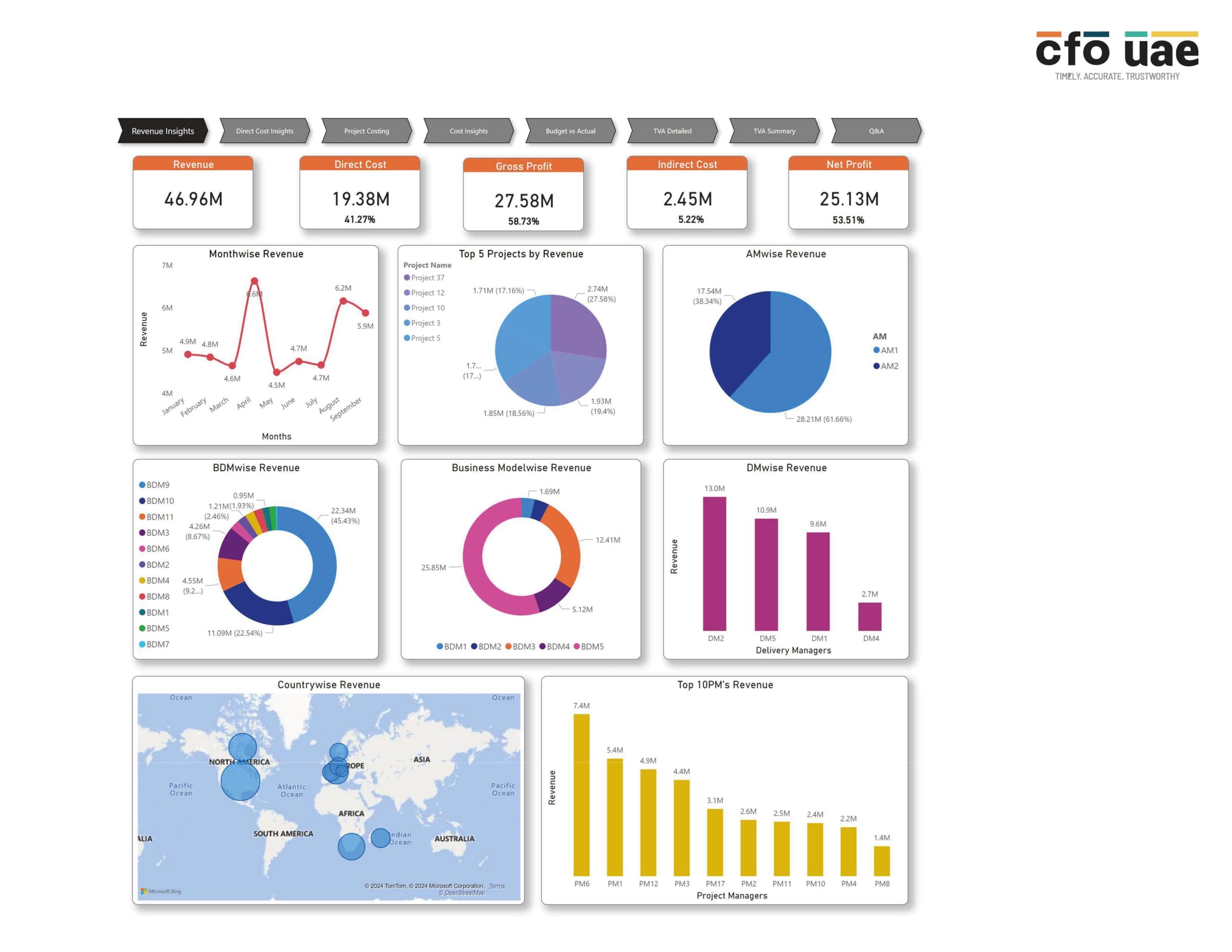

3. Visual Insights:

- Graphs, charts, and visual representations allow management to quickly grasp the overall status of ITR filings.

- Trends, bottlenecks, and potential delays are easily identifiable, enabling proactive decision-making.

4. Customizable Filters:

- Users can filter data based on parameters such as department, employee, or filing type.

- This flexibility allows management to focus on specific areas that require attention.

5. Automated Reminders:

- The dashboard sends automated reminders to employees and compliance officers for pending filings.

- Deadlines are tracked, and notifications are issued to prevent delays.

6. Improved Compliance:

- With better visibility into the filing process, compliance rates have improved significantly.

- The dashboard encourages timely submissions and reduces the risk of missing deadlines.